Ghana is closing the difficult chapter of its economic history, a trajectory set towards the path of recovery, Finance Minister, Dr. Cassiel Ato Baah Forson, has said.

“We are steadily closing this difficult chapter in our economic history, and doing so with a solemn pledge: never again shall our people be subjected to such hardship,” he has stated.

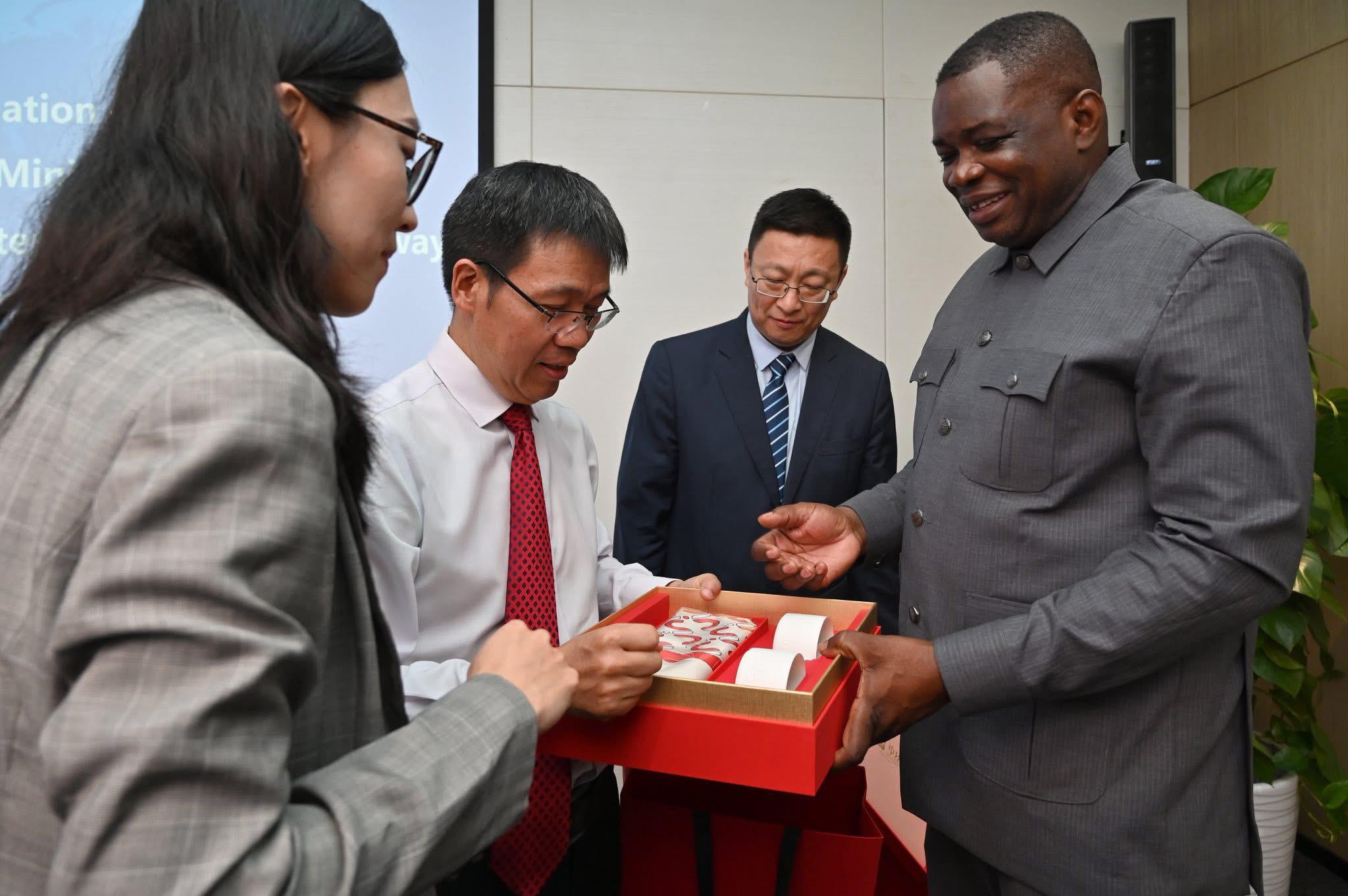

Sharing a piece on his Facebook Tuesday, July 01, 2025, after a trip from China, the Minister noted that the “constructive and forward-looking engagements with China’s Ministry of Finance, China Exim Bank” as well as some of Ghana’s key financial and contractor creditors, shows the economy is on the path of recovery.

The discussions forms part of finalising the country’s debt restructuring process.

According to him “the progress we’ve made gives me great confidence that we are on the brink of a new era of stability, resilience, and inclusive growth.”

The Ajumako Enyan Essiam Member of Parliament stated that the discussions that took place in China represents a giant step in concluding what the current administration inherited as debt exchange from the previous government.

“These discussions represent a monumental step forward in our efforts to bring finality to the debt restructuring process we inherited.”

Dr. Forson added that “this mission was not just about numbers and negotiations” but rather an engagement that focuses on “safeguarding the future of our economy and the wellbeing of every Ghanaian.”

The Minister was confident that Ghana was closing in on the difficult chapter of its economic history, counting on the gains this administration has chalked within the few months in office to change Ghana’s economic narrative.

The debt exchange programme, initiated by the Akufo-Addo government in December 2022, involved bondholders exchanging their existing bonds for new ones with extended maturities and altered coupon payments.

The goal, the government explained, was to reduce the burden of short-term debt and create more manageable debt servicing obligations.

Despite facing initial resistance from investors, particularly pension funds and individual bondholders, the then government made some concessions to address concerns and implemented nonetheless.

Despite the challenges, the programme was largely successful, with a significant percentage of bondholders participating.

Ghana is also engaged in restructuring its external debt, including Eurobonds and loans from bilateral creditors with a Memorandum of Understanding (MoU) currently reached between the state and its official bilateral creditors, including China and France, to restructure a significant portion of its external debt.

An Exchange Offer and Consent Solicitation process was launched in September 2024 to restructure the country’s US$13 billion Eurobond portfolio, which is crucial for achieving debt sustainability and accessing further financial support from the IMF.

With him was the Minister of Roads and Highways, Governs Kwame Agbodza, and other high-ranking officials of the Ministry.

DDEP: Gov’t to repay GHC150bn domestic debt in 4 years – Ato Forson