Ghana is Africa’s second most indebted country to the International Monetary Fund (IMF) in terms of Concessional Lending and Debt Relief Trust.

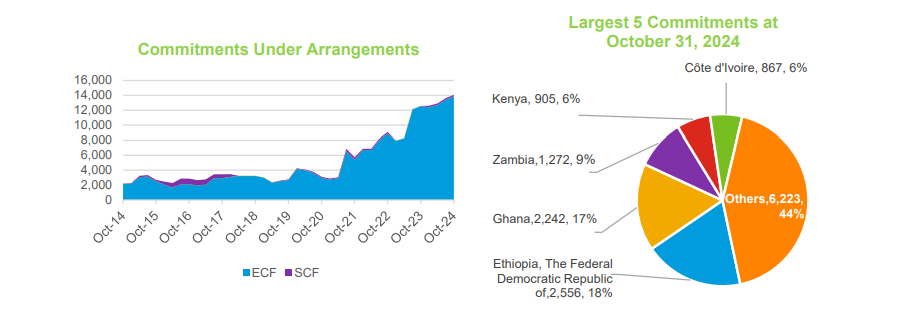

Reports indicate the country’s exposure to the Fund stood at 2.242 billion Special Drawing Rights, an equivalent of US$2.914 billion as of October 31, 2024.

Ghana until recently, was the most indebted country to the Bretton Woods Institution.

The West African nation’s exposure represented 17% of the total Africa borrowings from the IMF.

Democratic Republic of Congo tops the list with an indebtedness of $2.256 billion SDR to the IMF.

Zambia came after Ghana by placing 3rd with an SDR of 1.272 billion indebtedness to the IMF, with the two nations defaulting on their loan repayment and seeking a bailout from the IMF.

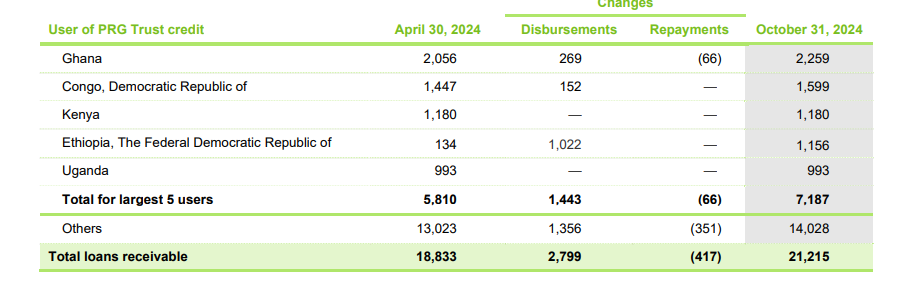

The Bretton Wood Institution’s Quarterly Finances indicate that Ghana’s outstanding concessional loans the IMF were higher than that of July 2024.

In January 2023, Ghana sought a bailout from the IMF after its economy nearly went bankrupt with severe challenges. The Fund approved US$3 billion bailout package for the country to be released in tranches of US$600 million to help revive Ghana’s economy.

Ghana has so far received $1.92 from the Breton Woods institution under the Economic Credit Facility Programme.

The nation’s loan exposure to the Bretton Woods institution is classified as concessional lending with low-interest financing.

The PRG Trust provides loans on concessional terms to qualifying low-income member countries.

Joint Transition Committee to ensure Mahama’s takeover inaugurated