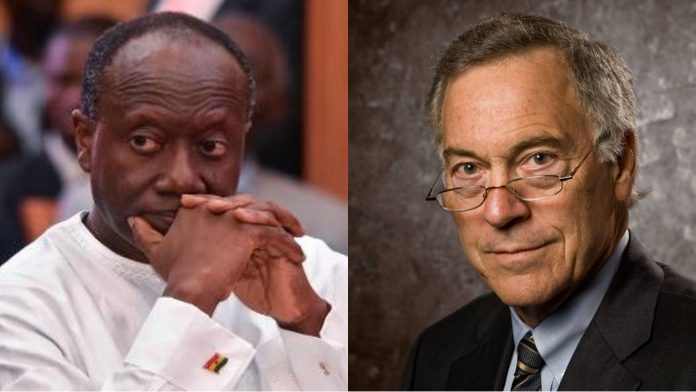

Johns Hopkins University’s Prof. Steve Hanke has advised Ghana to revisits its 1913 to 1958 module in the then Gold Gold Coast to install a currency board.

The Professor of Economics says that is “the only constructive way to smash Ghana’s inflation” after measuring the figure at 87% over the year.

Prof. Hanke’s comment is in response to the IMF’s conclusion of its meeting with Ghana over the bailout talks which they deemed “constructive”.

The Reuters whose report on the IMF Prof. Hanke had responded to had indicated the International Monetary Fund said on Friday that talks with Ghana’s government about a potential loan programme had been constructive but that more work was needed on a debt-sustainability analysis.

Ghana approached the IMF for financial support in July as foreign investors dumped its debt and as street protests broke out over rocketing prices.

A team from the Fund arrived days later to begin talks on a support programme and reforms to restore macroeconomic stability and debt sustainability in the gold, oil and cocoa-producing nation.

Discussions resumed on September 26 with a mission that ended on Friday.

The IMF said in a statement that its staff would now return to Washington for further technical work including assessing Ghana’s debt sustainability.

“The discussions with the authorities will also continue in the weeks ahead. … We reaffirm our commitment to support Ghana in these challenging times,” the fund added.

Ghanaian policymakers have taken steps to address the economy’s rapid deterioration, including cutting spending and implementing aggressive interest rate hikes.

The central bank raised its main lending rate (GHCBIR=ECI) by a further 250 basis points to a five-year high of 24.5% on Thursday, saying inflation and risks remained high.

The cedi currency is down around 40% against the dollar this year although its slide has slowed, aided by the disbursement of a $750 million loan from Afrexim bank and the signing of a syndicated cocoa loan of $1.13 billion.

Inflation, however, climbed to a 21-year peak of 33.9% in August (GHCPIY=ECI).

Net foreign reserves have dwindled to $2.7 billion in September from $6.1 billion in January.

Source: Onuaonline.com|Ghana/Reuters