In normal political discussions in Ghana, particularly among the country’s elite, Dr. Mahamudu Bawumia frequently faces criticism due to his dual role as Vice President and Head of the Economic Management Team (EMT). Despite relentless efforts by the opposition NDC to depict him as the least effective Vice President, empirical data contradicts this narrative. In this article, I present a compelling argument based on two key macroeconomic indicators: the GDP-debt ratio and the Primary Balance.

To begin with, the debt-to-GDP ratio serves as a crucial metric in assessing a nation’s economic health. The debt-to-GDP ratio, denotes the proportion of a country’s debt to its gross domestic product (GDP). This ratio, typically expressed as a percentage, serves as a measure to assess a country’s capacity to service its debt obligations. A lower ratio indicates a more favorable fiscal position, suggesting that the country’s economic output is relatively robust compared to its debt burden. Analysis of historical data under the 4th Republic reveals that notwithstanding global economic shocks, Ghana has witnessed notable improvements in the debt-to-GDP ratio under Dr. Bawumia’s stewardship, signifying a more sustainable fiscal trajectory compared to previous administrations under the fourth Republic.

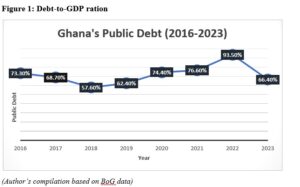

After attaining the HIPC completion point and benefiting from substantial external debt reliefs, Ghana’s debt-to-GDP ratio, which stood at 182% in 2000, dropped to 26% in 2006. It however went up marginally to 32% at the end of 2008 and reached an unsustainable level of 71% in 2014 and 73.3% percent at the end of 2016. In 2017, the country’s debt-to-GDP ratio declined (for the first time since 2006) to 68.70% (see Figure 1).

The Ghanaian economy was rebased in 2018 and the 2013 constant prices were adopted. The economy became 24.2% bigger and therefore debt-to-GDP became smaller!! The debt-to-GDP that was 73.3% in 2016 (in 2006 constant prices) became 57.06% (in 2013 constant prices) after the rebase.

The debt-to-GDP ratio experienced a gradual but moderate decrease from 68.70% in December 2017 to 62.40% by the end of 2019, marking a historically slow pace of growth. However, concerns arose as the ratio surged to 76.60% by the end of 2021, followed by a further increase to 93.5% by December 2022. This rapid escalation raised alarms regarding the country’s fiscal sustainability and economic stability. Between 2020 and 2022, Ghana encountered significant economic challenges exacerbated by the pandemic, which halted global activities abruptly. The COVID-19 pandemic and the Russia-Ukraine conflict triggered an economic downturn leading to negative GDP growth across many Countries.

For instance, in 2020, Germany experienced a decline in its growth rate from 1.1% to -3.8%, while the UK saw a significant drop from 1.6% to -11%. Similarly, the US GDP growth rate fell from 2.3% to -2.8%, India’s economy declined from 3.9% to -5.8%, and Indonesia’s decreased from 5% to -2.1%. Israel’s economy shrank from 3.8% to -1.5%, Italy experienced a substantial fall from 0.5% to -9%, and Japan’s economy decreased from -0.4% in 2019 to -4.2% in 2020. Additionally, Switzerland’s growth rate also declined from 1.2% in 2019 to -2.3% in 2020.

Compounding these external shocks were two major expenditure items aggravating Ghana’s economic health: the banking sector cleanup and the energy sector excess capacity payments. These expenditures, coupled with COVID-19-related costs, amounted to GHC50.1 billion, financed predominantly through borrowing. Banks serve a pivotal function by providing credit and liquidity to the economy. However, when banks fail in fulfilling this vital role due to insolvency or illiquidity, it significantly impedes economic development. In response to such challenges, the government of Ghana allocated GHȻ18.99 billion (equivalent to 5.49% of GDP) to facilitate the repayment of deposits to affected depositors. This initiative also involved the establishment of a bridge bank, known as Consolidated Bank Ghana Limited, as part of the remedial measures.

Again, by the year 2020, Ghana was spending more than US$500 million annually on excess capacity payments, which essentially amounted to compensation for power that remained unused or not needed. This situation arose as a response to the urgent need for emergency power to combat the recurring problem of load-shedding, locally termed as “dumsor,” which severely disrupted businesses and negatively impacted GDP growth under the NDC. The NDC government, in an effort to address this challenge, entered into contracts with Independent Power Producers (IPPs) in a manner lacking coordination and competitiveness, resulting in huge debt.

Fortunately, by August 2023, there was a notable turnaround, with the debt-to-GDP ratio declining to 66.4%. This reduction signaled a positive shift in the country’s fiscal trajectory, offering hope for improved financial health and economic resilience.

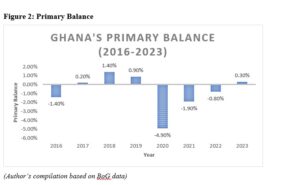

Another macroeconomic indicator which has seen improvement under the stewardship of Dr Bawumia’s EMT is the Primary Balance. The Primary Balance, which reflects the difference between government revenue and non-interest expenditure, excluding debt payments, is another vital indicator of fiscal management. This difference can be expressed as a percentage of GDP. In other words, the primary balance is similar to the difference between your monthly income and your monthly expenditure, excluding any funds allocated to repay debts such as your mortgage or car loan.

A positive primary balance implies that the government generates sufficient revenue to cover its operational expenses, thereby reducing reliance on borrowing to fund day-to-day operations. Dr. Bawumia’s tenure has seen commendable strides in achieving primary surpluses, indicating prudent fiscal management and a commitment to fiscal discipline, compared to successive governments. The superior performance of Dr Bawumia led EMT in debt management is reflected in the positive primary balance recorded in 2017 for the first time in 15 years!

Ghana recorded a primary surplus of GH¢434.5 million (0.2% of GDP) in 2017 (see Figure 2). Ghana continuously recorded positive primary balance in 2018 and 2019. Unfortunately, in 2020, 2021 and 2022, the country recorded negative primary balance. However, at the first half of 2023, the country again, recorded a positive primary balance.

The pertinent question that emerges is, why do we need a primary surplus? A primary surplus, as observed in 2017, 2018, 2019, and 2023 in Figure 2, allow us to manage our debt obligations and reduce overall debt burden. By reallocating our expenditures and reducing our debt, we can generate the much-needed fiscal space. This fiscal space, can be utilized to fund projects aimed at invigorating the economy.

In conclusion, despite facing criticism, and the opposition’s efforts to undermine his contributions, Dr. Mahamudu Bawumia’s tenure as Vice President and Head of the Economic Management Team has been characterized by tangible improvements in key macroeconomic indicators. The empirical data underscores his effectiveness in steering Ghana’s economy towards a path of sustainable growth and fiscal stability!

Abbosey Okai Spare Parts Dealers Association welcomes Bawumia’s flat tax proposal